By: Stephen K. Shiu, Esq., real estate attorney and broker

The residential real estate market has been an extremely popular topic among investors and first time home buyers. As noted in my earlier post (http://sksreal.com/la-real-estate-hits-bottom/), residential real estate prices bottomed out in early 2012. Taking a look back at 2012, Southern California’s housing market ended last year on a positive note with sharp home-price gains and the highest sales for a December in three years. The region’s median home price (which is the point at which half the homes in the region sold for more and half for less) rose 19.6% in December over the same month last year to hit $323,000, real estate firm DataQuick reported. An estimated total of 20,274 new and previously owned homes and condominiums sold throughout the six-county region. That was a 5.1% increase from November and up 5.3% from December 2011.

Sales of foreclosed homes made up just 14.8% of the market last month, down from 15.4% the month before and 32.4% in December 2011. That compares with a high of 56.7% of the market in February 2009.

Market Economics: Low Inventory/High Demand

Increased home prices are a result of low supply and high demand. Much of this demand comes from a record level of cash buyers and investors that include institutional investors, “mom and pop” investors, and foreign investors (e.g., from China) who have had, in the recession, few viable real estate product types to invest in. Cash buyers bought up 33.8% of all resale homes last month, while absentee buyers purchased 29.1% of Southland homes in December, DataQuick said. In addition, low interest rates (3.42% for a 30-year fixed mortgage as of last week per Freddie Mac) motivate buyers without “all cash” to finance their home purchases. In California, buyers can anticipate little new inventory on the market. A supply of only about 2 1/2 months’ worth of single-family homes for sale was available statewide at the end of December, based on a report from the California Association of Realtors. To the dismay of the average homebuyer, inventory is especially tight for homes below $500,000. However, this could mean for less competition for homes above $500,000.

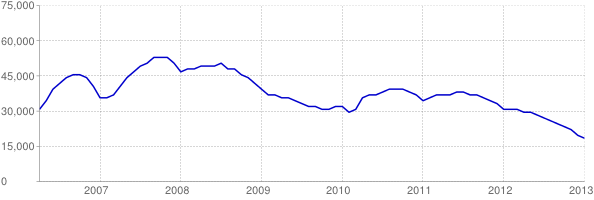

Housing Inventory for Los Angeles, California

Data from www.deptofnumbers.com

The housing supply should improve. Increasing consumer confidence and increasing home prices will encourage home owners to sell their homes and potentially purchase a move-up home. As home prices increase, the number of underwater borrowers (those homeowners who owe more on their mortgages than their homes are worth) will decrease and the tight for-sale inventory will begin to ease. “Consistent price increases throughout 2012 have started the process of lifting households out of negative equity, which will support home sales and refinancing volumes,” Paul Diggle, an economist for Capital Economics, wrote in an emailed analysis. “Lower levels of negative equity is good news for housing market activity and sets up a virtuous circle of rising activity leading to rising prices and pushing negative equity down further.”

Inventory may also increase due to shadow inventory (homes that will enter the market through bank sale, short sale or foreclosure) hitting the market. First, banks are shortening the time it takes to approve short sales and foreclosures. Second, Fannie and Freddie may give into pressure to stop or slow bulk property sales to investors and to release their inventory of homes for sale to the general market. However, “[t]he size of the shadow inventory continues to shrink from peak levels in terms of numbers of units and the dollars they represent,” says CoreLogic Chief Executive Anand Nallathambi. “We expect a gradual and progressive contraction in the shadow inventory in 2013 as investors continue to snap up foreclosed and REO properties and the broader recovery in housing market fundamentals takes hold.”

Conclusion

Last year was the first year of solid improvement since housing crashed in 2007. Data indicates that 2013 will also continue to bring home price gains. Therefore, now is the time to act while homes prices remain low and interest rates are at a historical low if you are in the market for a home. This makes even more sense if the home will be owner occupied as the rent to mortgage ratio (based on adjusted rent for Los Angeles against a 100% loan-to-value mortgage (30-year fixed) for the median price home using Realtor home sales statistics) for the Los Angeles area is at a buyer friendly .76 in September 2012 , and this does not include any applicable mortgage tax deduction.

Contact

The author, Stephen K. Shiu, Esq., is a real estate attorney and broker (CA DRE # 1921212) who offers clients real estate legal and brokerage services. For more information about these services, please visit www.sksreal.com. Stephen can be reached at (213) 359-8389 or via email at: sshiu@sksreal.com.

Sources

http://www.deptofnumbers.com/asking-prices/california/los-angeles/ http://www.deptofnumbers.com/affordability/california/los-angeles/#price-to-rent http://www.latimes.com/business/money/la-fi-mo-home-prices-20130115,0,934836.story http://www.latimes.com/business/money/la-fi-mo-mortgage-rates–20130124,0,774963.story?track=rss

http://www.latimes.com/business/money/la-fi-mo-shadow-inventory-20130102,0,5839732.story